UAE Golden Visa – What is the first thing that comes to mind about it? The marvelling skyline and the epitome of luxury attract individuals from around the globe with a wide range of opportunities and better lifestyles. The latest initiative, the Golden Visa program, offers multiple pathways to long-term residency. Let’s delve into the various options, helping you navigate the intricate waters to discover which UAE Golden Visa suits you best.

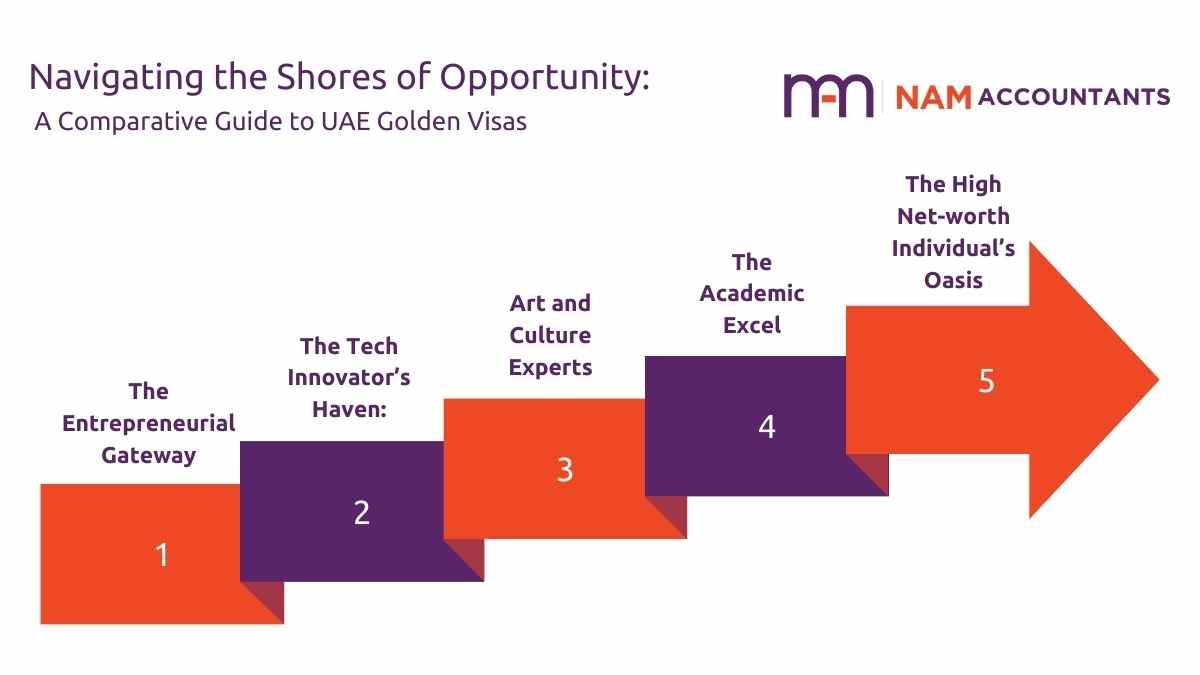

Understanding A Comparative Guide to UAE Golden Visas

First, let’s grasp what a Golden Visa is all about. Golden Visas are long-term resident permits with various benefits to encourage international investment and talent acquisition. In addition to longer stay benefits, holders may often sponsor family members, do business, and use a tax haven.

1. The Entrepreneurial Gateway

For those with an entrepreneurial spirit, the UAE offers a Golden Visa tailored to people in business and investors. This option typically requires a substantial investment in a local business, real estate, or a startup. The benefits are manifold, from a prolonged stay to the prospect of contributing to the vibrant UAE economy.

2. The Tech Innovator’s Haven:

In an era driven by technological advancements, the UAE recognizes the importance of attracting top-tier tech talent. A specialized Golden Visa caters to professionals in science, technology, and innovation. If you’re at the forefront of cutting-edge developments, this pathway could be your express ticket to a thriving tech ecosystem.

3. Art and Culture Experts

For those immersed in the world of arts and culture, the UAE has crafted a Golden Visa that celebrates creativity. Accommodating artists, authors, and cultural enthusiasts, this pathway encourages the flourishing of artistic endeavors within the country’s dynamic landscape.

4. The Academic Excel:

The UAE understands the significance of fostering academic excellence. The Golden Visa for academics welcomes professors, researchers, and intellectuals, offering them an extended stay to contribute to the nation’s educational growth. If pursuing knowledge is your thing, this option might be your academic haven.

5. The High Net-worth Individual’s Oasis:

Tailored for high net-worth individuals, this Golden Visa caters to those with significant financial means. By investing in real estate, bank deposits, or other financial instruments, individuals can secure a residency to experience the luxury of the UAE for the long term.

With the wide range of Golden Visa options, the UAE presents a spectrum of choices, each catering to a specific set of skills, interests, and aspirations. Before setting sail towards your golden horizon, carefully weigh the factors that align with your personal and professional goals.

Whether you’re an entrepreneur seeking new markets, a tech visionary promoting innovation, an artist with exceptional experience, an academic nurturing mind, or a high net worth individual desiring a luxurious haven, the UAE has a Golden Visa with your name on it. Embark on this journey with the confidence that the UAE’s Golden Visa program is not merely a residency status; it’s an invitation to become an integral part of a nation that embraces diversity and champions success.