The Commercial Transactions Law underwent significant revisions recently in the UAE, one of which involved lowering the minimum age requirement for establishing a business. This alteration reflects the nation’s ongoing efforts to attract high net worth individuals, investors, and entrepreneurs.

With its streamlined procedures, swift processing times, and favorable legal framework, the UAE has become a magnet for global business endeavors. In 2023, the Ministry of Economy introduced several amendments to the Commercial Transactions Law, including the reduction of the minimum age for business ownership to 18. Notably, setting up a business in a UAE Free Zone is remarkably straightforward, as outlined by the Ministry of Economy in just six simple steps.

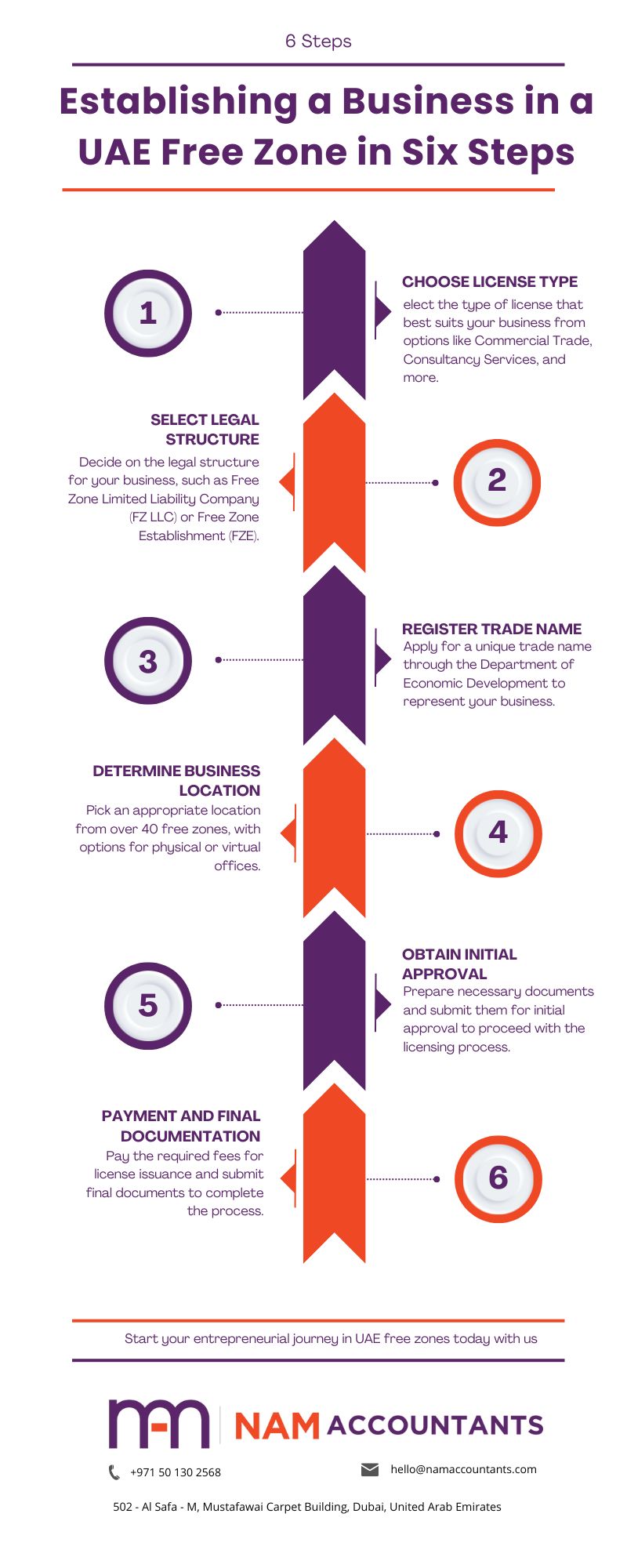

Step 1: Determine License Type

To initiate the process, identify the type of license suitable for your business within UAE Free Zones. Below are various categories to consider:

- Commercial Trade

- Consultancy Services

- Industrial

- Educational

- Media

- eCommerce

- Offshore

- Freelancer

- Warehousing

- Manufacturing

- Innovation

Identify the nature of your business and select the appropriate category accordingly.

Step 2: Choose Legal Structure

Your company can adopt one of three legal structures, each governed by specific rules and regulations tailored to the nature of your business:

- Free Zone Limited Liability Company (FZ LLC)

- Free Zone Company (FZ Co.)

- Free Zone Establishment (FZE)

Select the appropriate legal form based on your business requirements and preferences.

Step 3: Trade Name Registration Process

To register your trade name, utilize the Department of Economic Development’s app or website. Here are some key considerations:

- Ensure your trade name is distinct from any other registered company names.

- Adhere to specific terms and conditions, including:

- Indicating the legal structure of the company (e.g., LLC).

- Avoiding offensive or inappropriate language.

- Ensuring compatibility with your business.

- Excluding UAE ruler’s names or logos, official UAE government logos, foreign government names or logos, and government bodies’ names or logos.

- Verifying that the trade name isn’t already registered by another company.

- Obtaining approval for the trade name and trademark from the Department of Economic Development and the Ministry of Economy, respectively.

- Keep in mind that trade name certificates require periodic renewal.

Step 4: Business Location Selection

Now, it’s time to select a suitable location for your business from over 40 free zones across the country.

For an independent or professional license, you have the option to rent an office space or register with a virtual office.

The choice of office space depends on your company’s size and the nature of your operations. You can opt for fully-furnished or partially furnished offices, available for rent or purchase once you’ve obtained your commercial license. Typically, properties within free zones are available for rent.

Free zones provide various facilities to assist investors in setting up their businesses. These services include, but are not limited to, IT infrastructure support, obtaining NOC (No Objection Certificate) or ‘To whom it may concern’ letters, and facilitating the issuance, renewal, and cancellation of residence visas.

Step 5: Obtaining Initial Approval

To secure your initial approval, ensure all necessary documents are prepared and that you meet all mandatory criteria. Here’s a list of common documents you’ll need:

- Completed application form

- Business plan

- Copy of existing trade license/registration certificate (if applicable)

- Passport copies of the company’s shareholders and appointed manager

- Registry Identification Code Form (RIC) for appointed manager (original and notarized)

- Specimen signatures of the company’s shareholders and appointed manager

- Title deeds (if applicable)

- Brief letter outlining the investment idea and investor’s plan (Letter of Intent)

- Two years of audited financial reports or certificate of reference from a bank (as required)

- Documents commonly required for freelancers/professionals:

- Application for registration

- Curriculum vitae or profile

- Reference letter from a bank

- Registry Identification Form (RIC) for Director (original and notarized document)

Ensure all documents are accurately prepared and submitted to achieve initial approval efficiently.

Step 6: Payment and Final Documentation

In this step, you’ll need to settle the necessary fees to obtain your company license. These fees typically include issuance fees for the license itself.

Additionally, you’ll need to provide specific documents, some of which are outlined below:

- Completed application form for registration

- Board Resolution appointing Manager/Director (notarized and attested)

- Power of Attorney granted to Manager/Director (notarized and attested)

- Memorandum and Articles of Association (notarized and attested)

- Specimen signature of Manager/Director (notarized and attested)

- Passport-size photos of Manager/Director

- Share capital information

Ensure all necessary payments are made and documents are accurately prepared and submitted to finalize the licensing process for your company.