Determination of the corporate tax period and its deadline for submission

Knowledge of taxation is essential for running any business. Businesses operating in the UAE are required to have working knowledge of the system of taxation there, which includes the newly introduced corporate tax. In this article, we will delve into the details of corporate tax, its tax period, and the deadline for submission.

In an attempt to comply with international standards, the UAE government has introduced a new corporate tax structure. UAE is known for its oil-based economy, and the country aims to shift this narrative through the adoption of such a tax structure. The government has been investing in innovation and technology to diversify its sources of revenue. Further, the government has been making tax reforms to attract more businesses. The shift started with the introduction of VAT in 2018. With the introduction of corporate tax, this process has been taken a step further. The Ministry of Finance made the announcement regarding the introduction of corporate tax on January 31, 2022. The implementation of such a tax is expected to begin with the start of the new financial year in June 2023.

As prescribed in Clause 1 of the Article 51 of the Federal Decree Law No. 47 of 2022, Federal Tax Authority has issued a #Decision No. 3 of 2024 (effective from 1st March 24) specifying the timelines for Registration of Taxable Persons for the UAE Corporate Tax.

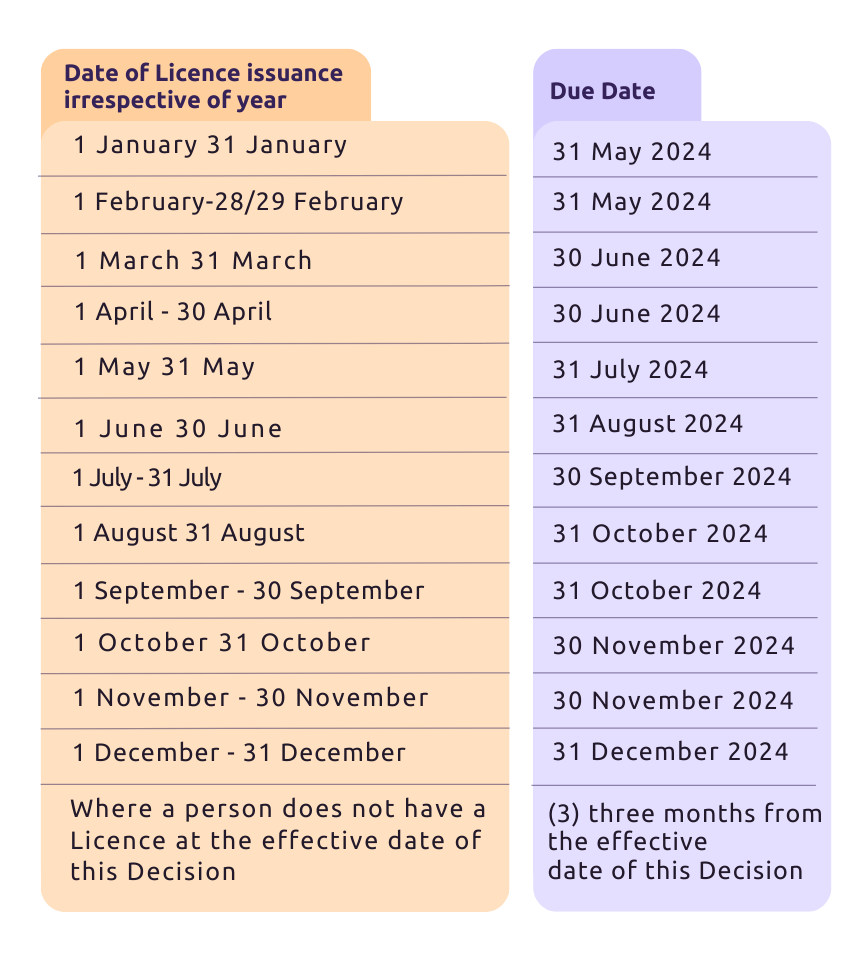

Last date of Tax Registration for a resident juridical person established before 1st March 2024 as under:

Check your Trade License and Act Accordingly