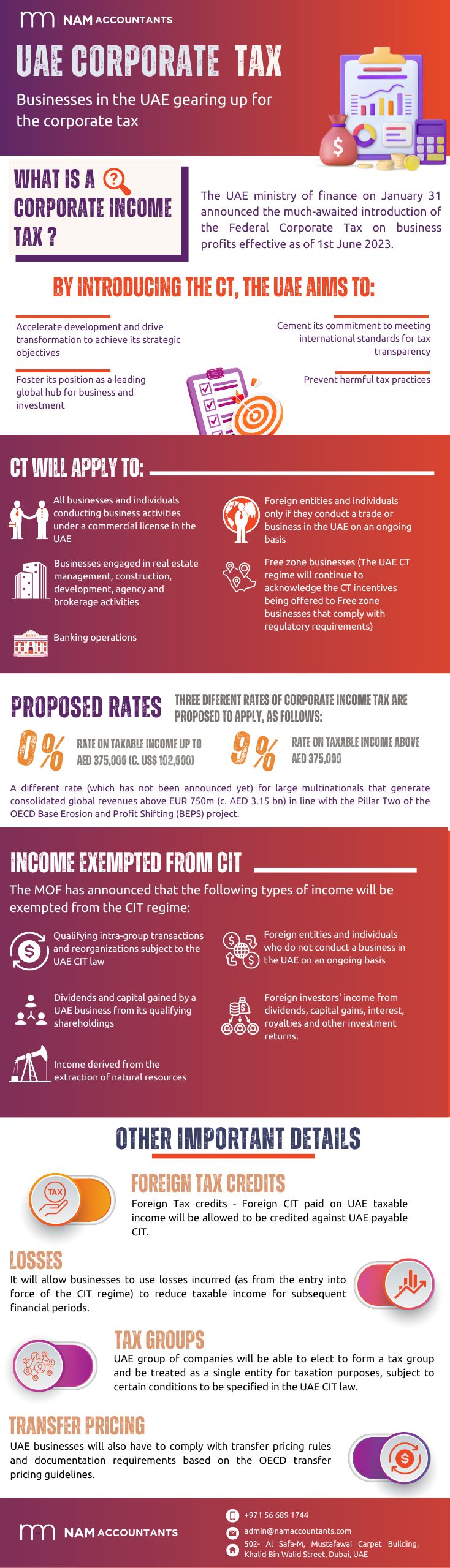

On January 31, the UAE Ministry of Finance made a landmark announcement regarding the introduction of the Federal UAE Corporate Tax on business profits, set to take effect from June 1, 2023. This development represents a monumental shift and a historic milestone for the UAE. Explore every facet of the new Federal Corporate Tax with this comprehensive infographic. We welcome your insights and opinions in the comments below.

UAE Corporate Tax Infography