Comparison of UAE Corporate Tax Rates vs. Global Tax Rate

In the ever-evolving landscape of international business, understanding corporate tax rates is like charting a course through turbulent waters. Among the varied destinations for investors, the United Arab Emirates (UAE) emerges as a prominent player, boasting tax policies that attract entrepreneurs and corporations alike. In this blog, we’ll embark on a voyage of discovery, comparing recently introduced UAE corporate tax rates with global standards to shed light on the advantages this Gulf nation offers to businesses worldwide.

Understanding UAE Corporate Tax Rates:

One of the most compelling aspects of doing business in the UAE is its favourable tax environment. Unlike many countries that levy hefty corporate taxes, the UAE adopted a strategic approach to taxation in 2023, still firmly holding on to its position as a tax haven for businesses seeking to optimise their financial performance.

The primary form of taxation in the UAE is the Value Added Tax (VAT), introduced in 2018. However, with the latest introduction of corporate income tax, the UAE sets itself apart by maintaining a corporate tax rate of 9% for businesses with annual taxable profit over AED 375000. This means that companies operating within the UAE are subject to corporate tax much lower than the global average rate of around 23.45%, making it an incredibly attractive destination for investment and business expansion in the GCC region.

Comparing UAE Corporate Tax Rates with Global Standards:

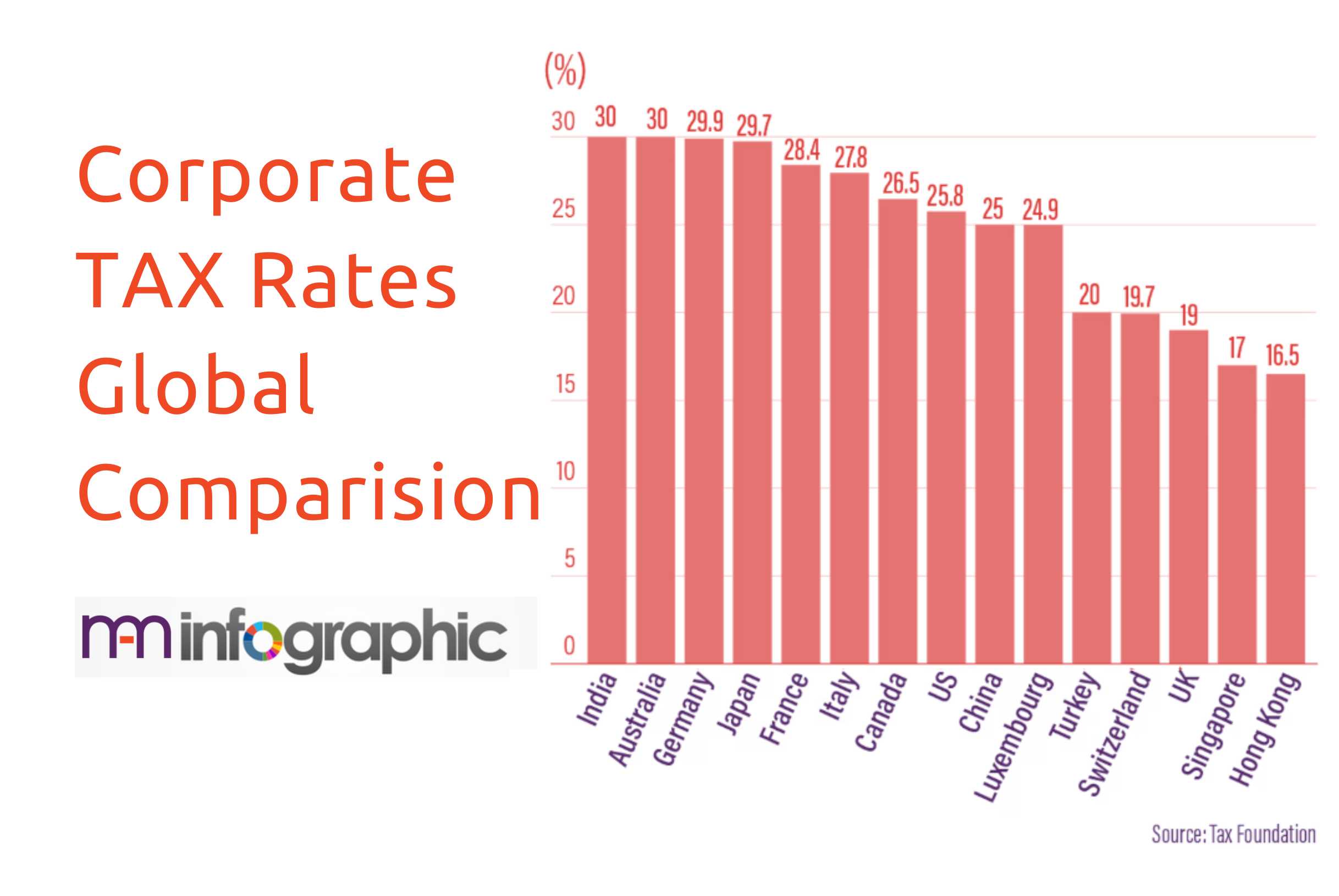

Let’s understand the uniqueness of the UAE’s tax regime by comparing its corporate tax rates with those of other countries around the world.

The UAE Corporate tax rate is 9% lower than the global average corporate tax rate, which is approximately 23.45%.

Corporate Taxes of Few Top Economies Across the World:

- United States: The US has a federal corporate tax rate that ranges from 15% to 35%, depending on the taxable income bracket. When combined with state taxes, the effective corporate tax rate can be even higher.

- United Kingdom: In the UK, the corporate tax rate is currently set at 19%, making it relatively competitive compared to other developed nations.

- Singapore: Often hailed as a business-friendly jurisdiction, Singapore imposes a corporate tax rate of 17%, making it one of the lowest in the Asia-Pacific region.

- Switzerland: Known for its stability and favourable business environment, Switzerland imposes a federal corporate tax rate that varies between 8.5% and 24.2%, depending on the canton where the company is located.

In the realm of global business, taxation plays a pivotal role in shaping investment decisions and corporate strategies. The UAE’s provision of a 9% corporate tax rate highlights its dedication to fostering economic growth, attracting foreign investment, and nurturing a business-friendly ecosystem. For businesses seeking to optimize their bottom line and expand their footprint in the Middle East and beyond, the UAE stands as a beacon of opportunity. By offering a tax-friendly environment coupled with political stability, world-class infrastructure, and strategic geographic positioning, the UAE continues to solidify its position as a premier destination for businesses seeking to thrive in the modern global economy.