On December 12, 2023, the UAE Federal Tax Authority (FTA) issued a Corporate Tax Guide focusing on the Taxation of Extractive Business and Non-Extractive Natural Resources Business.the UAE

This comprehensive guide outlines general instructions applicable to individuals engaged in Extractive Business or Non-Extractive Natural Resource Business within the UAE. Key aspects covered in the guide include:

1. Definition of Natural Resources, Extractive Business, and Non-Extractive Natural Resource Business:

| Expression | Definition |

|---|---|

| Natural Resources | Water, oil, gas, coal, naturally formed minerals, and other non-renewable, non-living resources extractable from the UAE’s territory. Excludes renewable resources like solar energy, wind, animals, and plant materials. |

| Extractive Business | The business activity involving exploration, extraction, removal, or production of Natural Resources within the State. Conducted through a right, concession, or license issued by a Local Government. |

| Non-Extractive Natural Resource Business | The business activity involving separation, treatment, refining, processing, storage, transportation, marketing, or distribution of UAE’s Natural Resources. Conducted through a right, concession, or license issued by a Local Government. |

2. Conditions to Qualify as an Exempt Person under Corporate Tax Law:

| No. | Expression | Extractive Business | Non-Extractive Natural Resource Business |

|---|---|---|---|

| 1 | The Person holds an interest in a right, concession, or License from a Local Government for the respective business in the UAE. | ✔ | ✔ |

| 2 | The Person is effectively subject to tax under the applicable legislation of the Local Government. | ✔ | ✔ |

| 3 | The Person has notified the Ministry of Finance as per the agreed form and manner with the Local Government. | ✔ | ✔ |

| 4 | Income from Non-Extractive Natural Resource Business is derived solely from Persons undertaking a B2B Business or Business Activity. | ✔ |

3. Direct or Indirect Holding of Licenses:

A company can either directly hold a license or indirectly operate through partnerships, collaborations, or joint ventures.

4. Contractors, Subcontractors, or Suppliers:

Exemption does not extend to other entities such as contractors, subcontractors, or suppliers that don’t meet the exemption conditions.

5. Exceptional Cases:

If conditions are not met during a Tax Period, the Person ceases to be exempt, unless exceptional circumstances apply.

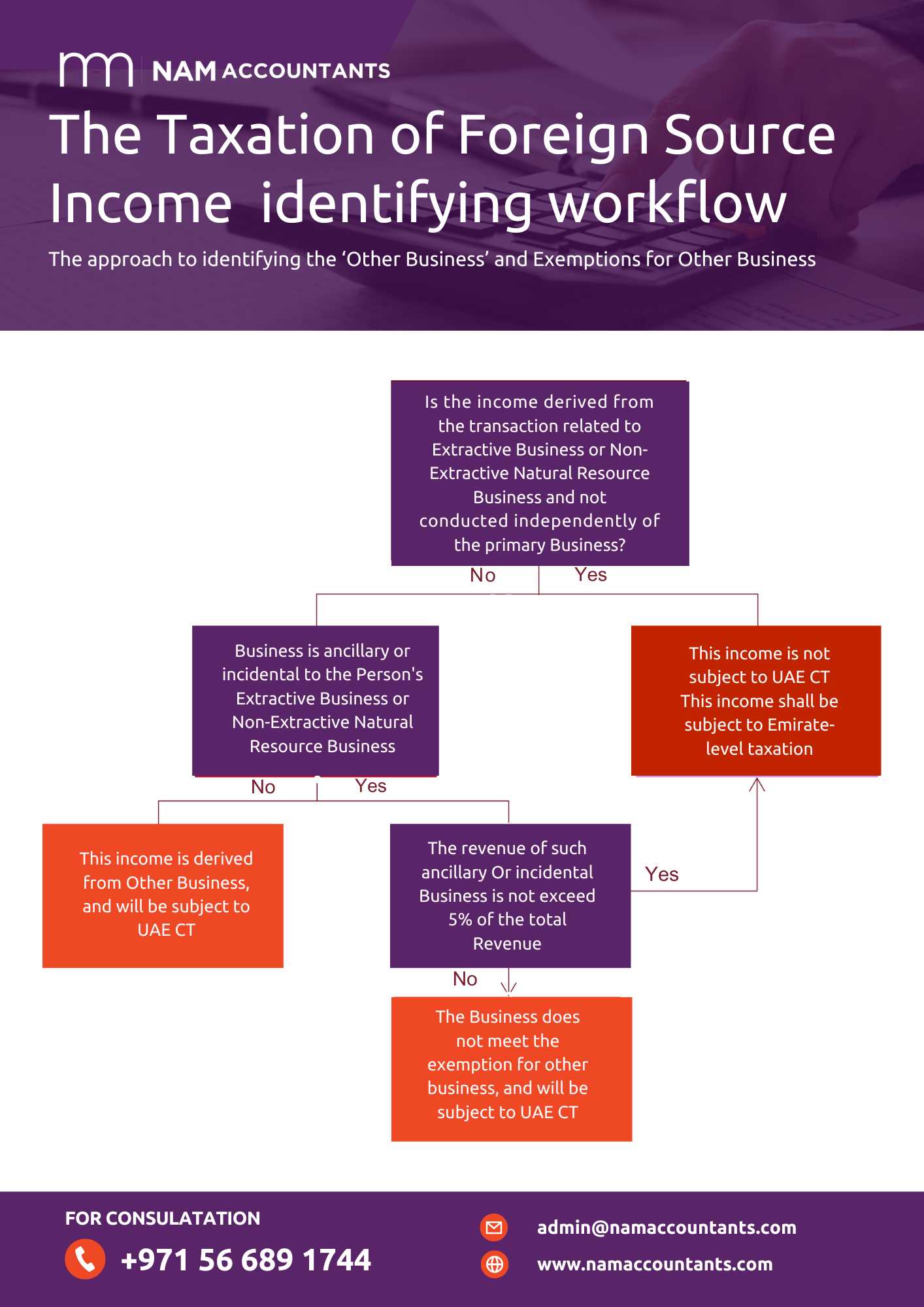

6. Identifying ‘Other Business’ and Exemptions:

Workflow for identifying and exempting ‘Other Business’ under the Taxation of Foreign Source Income.

7. Determining Taxable Income of ‘Other Business’:

Maintain separate Financial Statements for the independent treatment of ‘Other Business’. Common expenditures require appropriate apportionment.

8. Compliance Requirements:

Exempt Persons must maintain records for seven years post the Tax Period claiming exemption.

9. Examples:

The guide provides examples for clarity on holding licenses, contractors, subcontractors, ancillary or incidental tests, and treatment as a separate entity.

While the guide is not legally binding, it serves as a valuable resource for understanding Extractive Businesses and Non-Extractive Natural Resource Businesses. Access the full guide here (PDF 402 KB).